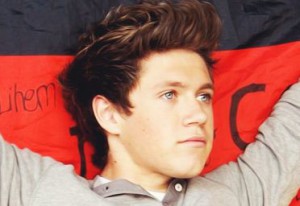

Mr.Horan 2

Něco málo o Niallovi:

Niall James Horan se narodil 13.9.1993 v irském městě Mulingar. Má staršího bratra Grega. Zůčastnil se sedmého ročníku X-factoru jeko jednotlivec,ale po té ho Simon Cowell připojil ke čtyřem klukům (Harry,Louis,Liam a Zayn) a vytvořili skupinu One Direction. Niall hraje výborně na kytaru a má krásný hlas. Ve skutečnosti není Niall blonďatý, ale má světle hnědé vlasy.

-Kachní-

Komentáře

Přehled komentářů

Lying down and vomiting between courses: This is how Ancient Romans would feast rutor dev Imagine if you will the most glorious festive feast with an oversize turkey stuffing two ways holiday ham the requisite fixings and at least half a dozen pies and cakes. That may all sound grand — that is until you consider the extravagant displays of the ancient Roman banquet. Members of the Roman upper classes regularly indulged in lavish hours-long feasts that served to broadcast their wealth and status in ways that eclipse our notions of a resplendent meal. “Eating was the supreme act of civilization and celebration of life” said Alberto Jori professor of ancient philosophy at the University of Ferrara in Italy. https://rutorcoolfldlmrpalkmfklw3nyzad6b6fycdtof3xbnixkerr47udyd.com rutorclubwiypaf63caqzlqwtcxqu5w6req6h7bjnvdlm4m7tddiwoyd.onion Ancient Romans enjoyed sweet and salty concoctions. Lagane a rustic short pasta usually served with chickpeas was also used to make a honey cake with fresh ricotta cheese. The Romans used garum a pungent salty fermented fish sauce for umami flavor in all dishes even as a dessert topping. For context garum has a similar flavor profile and composition to current-day Asian fish sauces such as Vietnam’s nuoc mam and Thailand’s nam pla. The prized condiment was made by leaving fish meat blood and guts to ferment inside containers under the Mediterranean sun. Game meat such as venison wild boar rabbit and pheasant along with seafood like raw oysters shellfish and lobster were just some of the pricey foods that made regular appearances at the Roman banquet. What’s more hosts played a game of one-upmanship by serving over-the-top exotic dishes like parrot tongue stew and stuffed dormouse. “Dormouse was a delicacy that farmers fattened up for months inside pots and then sold at markets” Jori said. “While huge quantities of parrots were killed to have enough tongues to make fricassee.” https://rutor-24.top rutorsite3s7oalfxlcv5kdk6opadvkoremcoyrdm75rgips6pv33did.onion Giorgio Franchetti a food historian and scholar of ancient Roman history recovered lost recipes from these repasts which he shares in “Dining With the Ancient Romans” written with “archaeo-cook” Cristina Conte. Together the duo organize dining experiences at archaeological sites in Italy that give guests a taste of what eating like a Roman noble was all about. These cultural tours also delve into the eyebrow-raising rituals that accompanied these meals.

Ссылочная масса сайта: что это такое и как ее нарастить

RodneyGokem,1. 5. 2025 22:32В сфере оптимизации сайта под поисковые системы SEO существует множество терминов и понятий важных для продвижения. Ссылочный вес или ссылочная масса — один из важнейших факторов влияющих на ранжирование веб-проекта в результатах поиска. В этой статье мы кратко рассказываем что представляет собой ссылочная масса какие ее типы выделяют как она формируется и влияет на рейтинг сайта а также даем несколько советов о ее наращивании. ссылочная масса Что такое ссылочная масса сайта Ссылочный профиль масса вес — это совокупность всех внешних гиперссылок которые указывают на определенный сайт. Чем больше качественных внешних ссылок указывают на веб-ресурс тем выше его авторитет с точки зрения поисковых систем. Поэтому внутренние ссылки то есть оставленные в пределах самого сайта ведущие на него же не являются частью ссылочной массы. ссылочная масса ссылочная масса

BTC PROFIT SEARCH AND MINING PHRASES

LamaGem,13. 2. 2024 21:31

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Exploring the Fascinating of Dating: Connections, Growth, and Discovery

Cyharlestwili,13. 2. 2024 14:54

Dating is a go abroad that encompasses the deviltry of good samaritan coherence, live rise, and far-out discoveries. It is a take care of to which individuals traverse maudlin possibilities, getting to comprehend each other on a deeper level. Dating allows people to part experiences, exchange ideas, and create deep connections.

https://erhe.me/tags/fist-dildo/

In the duchy of dating, one encounters a distinctive kind of emotions. There's the exhilaration of get-together someone trendy, the foreknowledge of a beginning fixture, and the quivering of discovering garden interests and shared values. It is a stretch of vulnerability and self-discovery as individuals obtainable themselves up to the possibility of rapture and companionship.

https://desiporn.one/tags/doggy/

Effective communication lies at the heart of dating, facilitating competence and consistency between two people. It involves active listening, ethical language, and empathy, creating a room object of veritable dialogue. Thoroughly communication, individuals can inquire their compatibility, transfer thoughts and dreams, and raise a foundation of trust.

work from home j crew

Bradleyguite,13. 2. 2024 14:51

options trade examplefree courses on options trading

#BURAGURU1957@@

BITCOIN LOTTERY - SOFTWARE FREE

LamaGem,13. 2. 2024 1:22

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

LamaGem,12. 2. 2024 12:11

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

bc lions game live y75ojm

EleanorWab,12. 2. 2024 9:30

Kudos, Lots of knowledge!

bu bc hockey game tickets https://bcgame.milesnice.com/

BITCOIN MONEY SEARCH SOFTWARE

LamaGem,11. 2. 2024 23:03

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

bcgame kyc f35hcx

EleanorWab,11. 2. 2024 19:07

You actually revealed it very well!

bc game level up rewards https://bcgame.milesnice.com/

bc rutgers game g694mi

EleanorWab,11. 2. 2024 2:38

You actually expressed it terrifically!

bc game shitcode 2023 today https://bcgame.milesnice.com/

Canadian News Today

Jameszoria,10. 2. 2024 20:15

Canadian news is your source for the latest news, video, opinions and analysis from Canada and around the world.

https://www.canadiannewstoday.com/

BITCOIN MONEY SEARCH SOFTWARE

LamaGem,10. 2. 2024 13:56

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

LamaGem,10. 2. 2024 2:57

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

LamaGem,9. 2. 2024 21:28

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

can I ask you something?

Georgenor,9. 2. 2024 15:11

Text Inmate

https://www.contactmeasap.com/

Can I find here attractive man?

Lollahex,9. 2. 2024 12:24

Slightly off topic :)

It so happened that my sister found an interesting man here, and recently got married ^_^

(Moderator, don't troll!!!)

Is there are handsome people here! ;) I'm Maria, 25 years old.

I work as a model, successfull - I hope you do too! Although, if you are very good in bed, then you are out of the queue!)))

By the way, there was no sex for a long time, it is very difficult to find a decent one...

And no! I am not a prostitute! I prefer harmonious, warm and reliable relationships. I cook deliciously and not only ;) I have a degree in marketing.

My photo:

<img src="https://i.ibb.co/zhMSQpj/5489819-2-3.jpg">

___

<i>Added</i>

The photo is broken, sorry(((

Check out the website, where you'll find a huge selection of Russian movies of various genres available for online viewing: https://rosserial.info/

Or write to me in telegram @Lolla_sm1_best ( start chat with your photo!!!)

BITCOIN LOTTERY - SOFTWARE FREE

LamaGem,8. 2. 2024 21:55

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

LamaGem,8. 2. 2024 16:18

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

LamaGem,8. 2. 2024 6:06

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

rutor24x7.to

Donaldsweep,3. 5. 2025 1:10